China Market Insight: Toys & Baby Products Accelerate in October as Tmall Promotion Drives Strong Demand

11.21.2025, 12:00:00 AM

11.21.2025, 12:00:00 AM

7

7

Home /Media Center / Press Release / China Market Insight: Toys & Baby Products Accelerate in October as Tmall Promotion Drives Strong Demand

11.21.2025, 12:00:00 AM

11.21.2025, 12:00:00 AM

7

7

Shanghai, China — The China Toy & Juvenile Products Association (CTJPA) today released its latest analysis of Tmall’s October sales data, revealing significant momentum in China’s toy, trendy toy, and baby product categories. Benefiting from the pre-sales and first wave of the “Double 11” shopping festival, October has become a key indicator of consumer sentiment and product acceptance in the Chinese market.

Strong Category Performance Highlights China’s Upward Consumer Trend

Across major categories, several segments delivered robust year-on-year (YoY) growth:

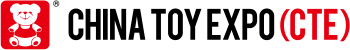

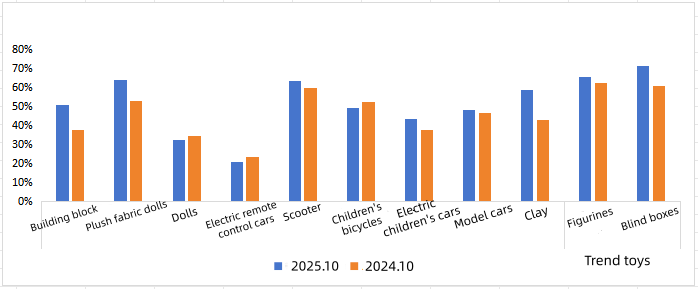

▲Sales volume and YoY performance of Art & Collectable Toys on Tmall in October

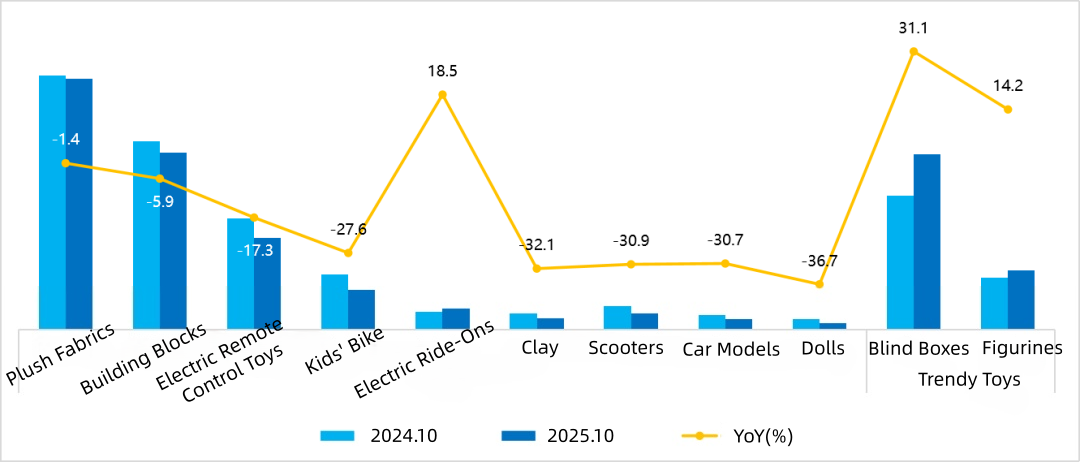

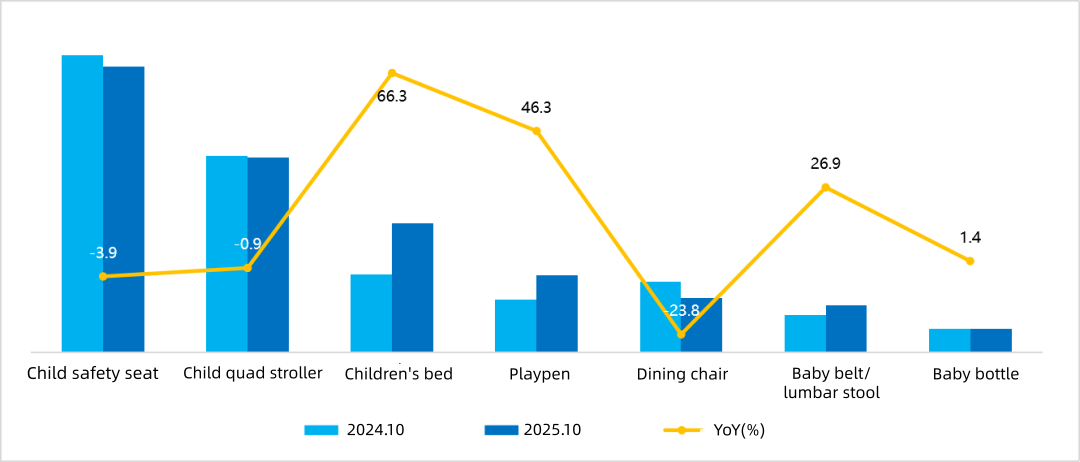

▲Sales volume and YoY performance of Baby and Children Products on Tmall in October

Average selling prices (ASP) also increased across most categories, particularly:

These price trends signal consumers’ willingness to trade up for better design, materials, and functionality.

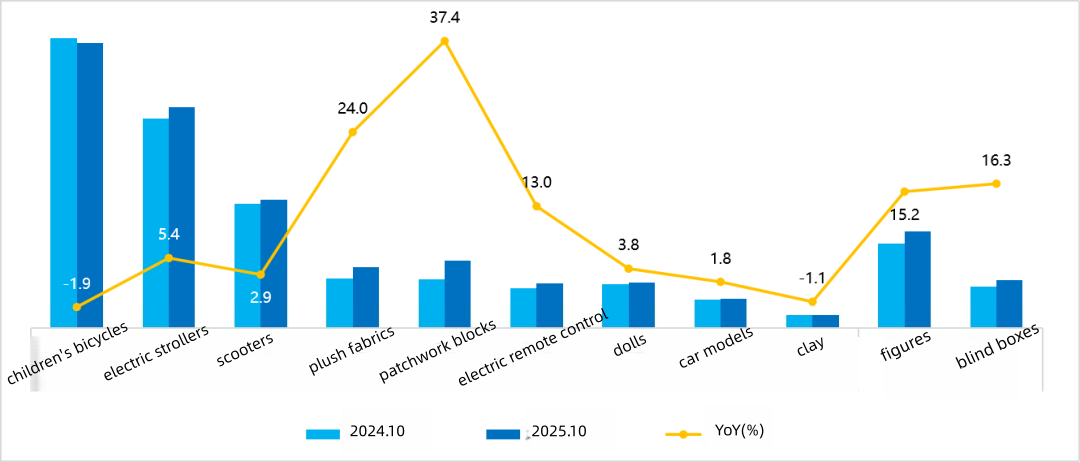

▲The average sales price and YoY situation of Art & Collectable Toys on the Tmall platform in October

▲The average sales price and YoY situation of Baby & Children Products on the Tmall platform in October

Three Key Consumer Trends Influencing China’s Market

1. Gift Sets and Combo Packs Become Seasonal Winners

Lego multi-set bundles, Bandai mystery “lucky bags,” and baby feeding gift boxes appeared frequently on bestseller lists. This reflects China’s growing preference for ready-to-gift, value-added, and curated product offerings, especially during major shopping festivals.

2. Premiumization in Baby Mobility Products

Chinese parents increasingly prioritize safety, comfort, portability, and smart features. High-spec strollers—featuring reversible seats, shock absorption, and refined design—captured a rising share. This shift toward functional premium items directly lifted the ASP of the entire travel category.

3. Stronger Market Concentration Among Leading Brands

Top global and domestic brands strengthened their positions in almost all categories.

For overseas stakeholders, this indicates a maturing market that increasingly rewards strong brand equity, product innovation, and differentiated positioning.

▲Changes in Market Share of Top 5 Art & Collectable Toys by Sales on Tmall Platform — October 2024/2025

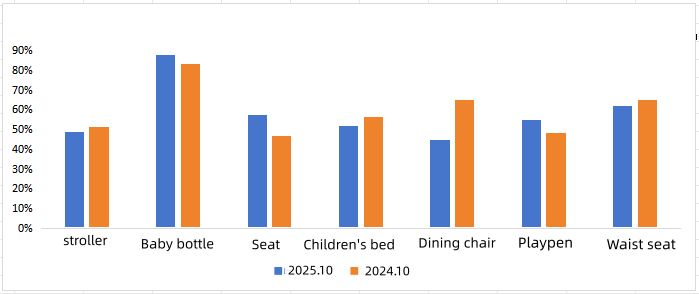

▲Changes in Market Share of Top 5 Baby & Children Products by Sales on Tmall Platform — October 2024/2025

Category Insights Relevant to Global Buyers & Brands

Building Blocks

China’s market is visibly segmented between high-end sets (RMB 1,000+) and everyday educational sets.

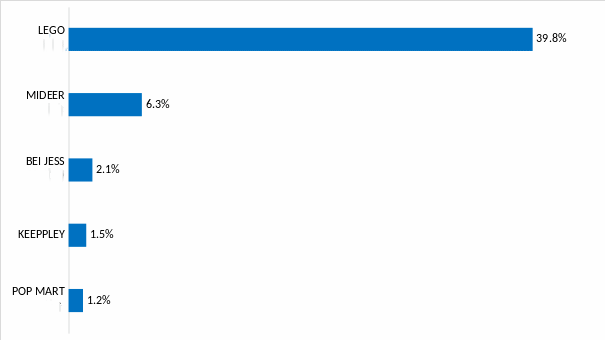

▲Top 5 Brands by Building Blocks Sales on Tmall in October

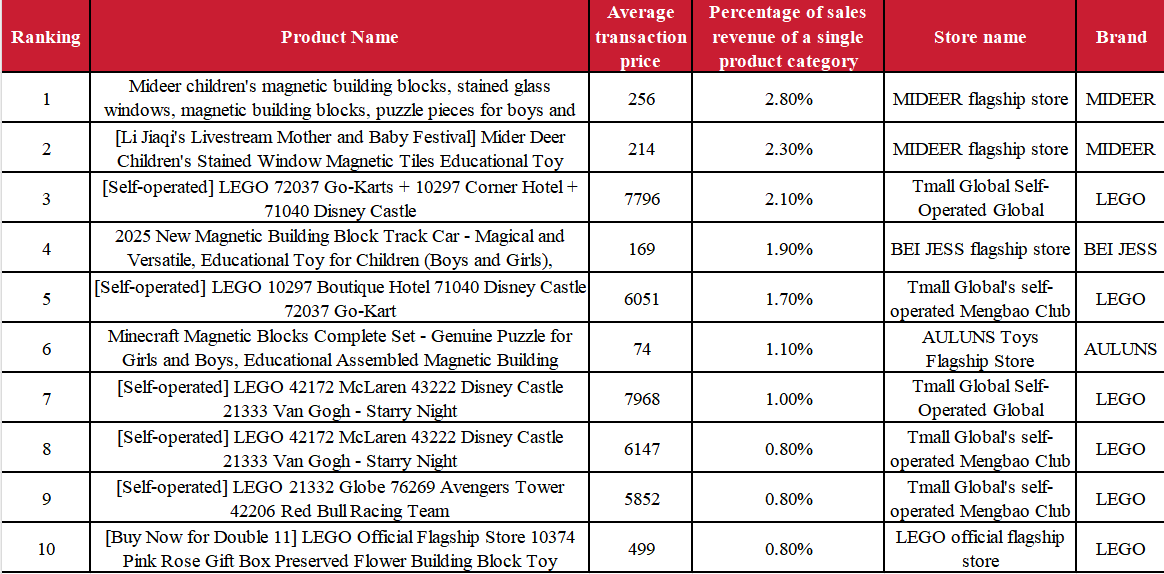

▲Top 10 Best-Selling Building Blocks Products by Sales on Tmall in October

Plush Toys

Emotional value drives consumption.

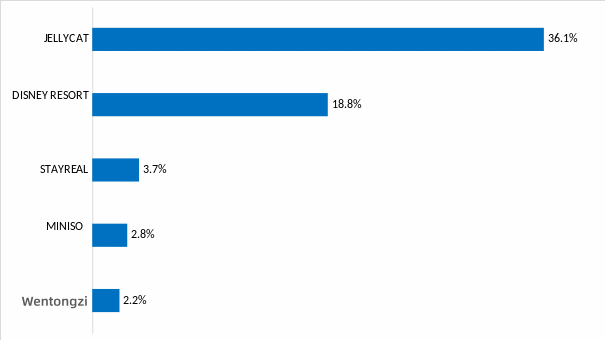

▲Top 5 Brands by Plush Toys Sales on Tmall in October

▲Top 10 Best-Selling Plush Toys Products by Sales on Tmall in October

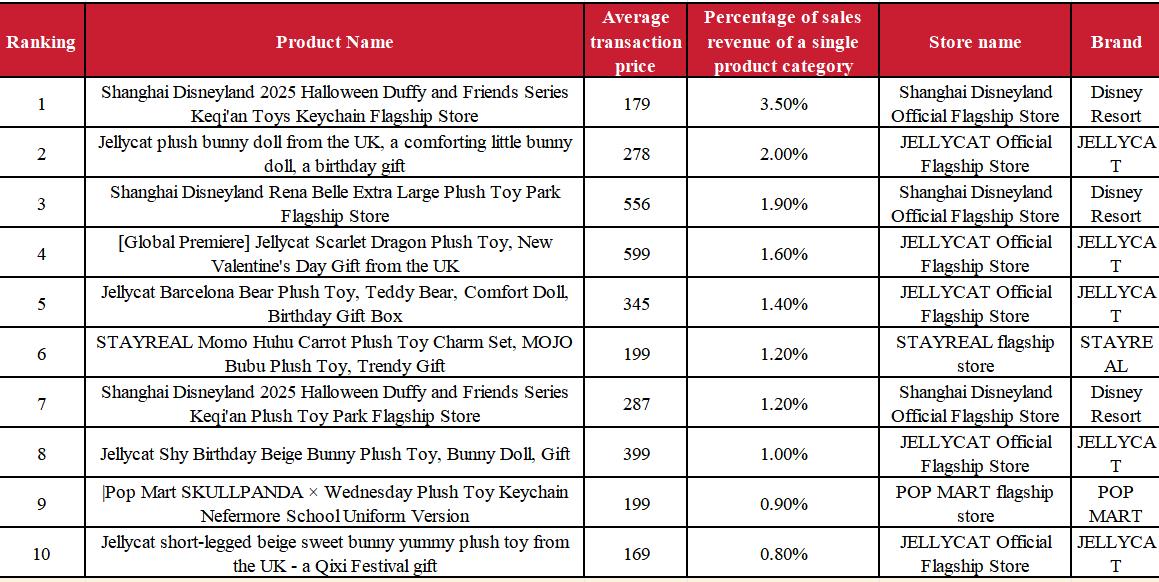

▲Top 10 Best-Selling Plush Toys Products by Sales on Tmall in October

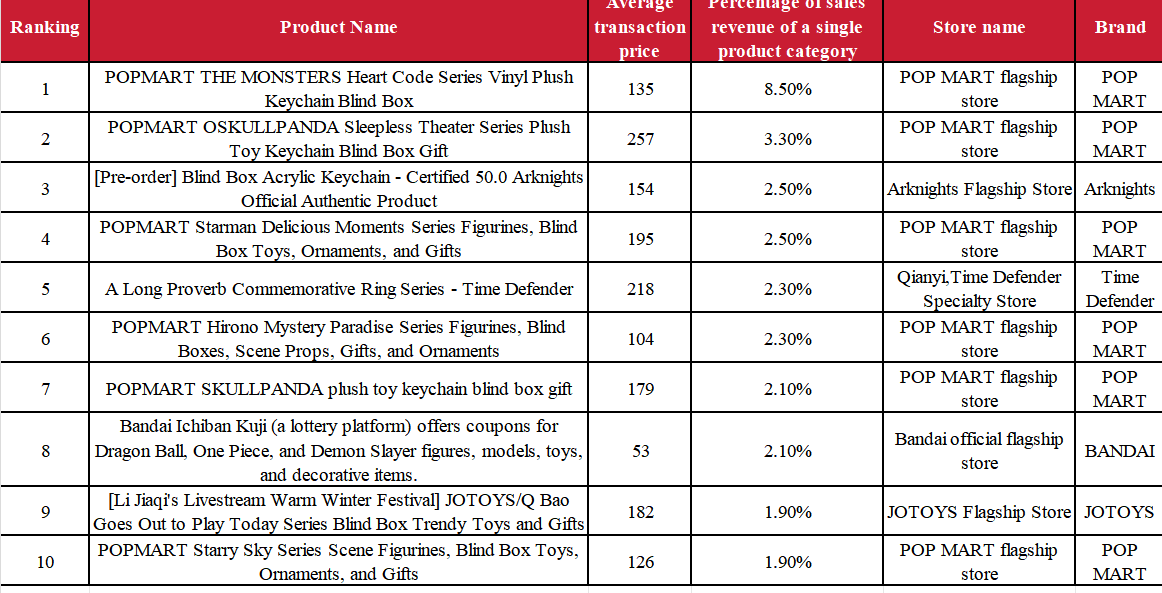

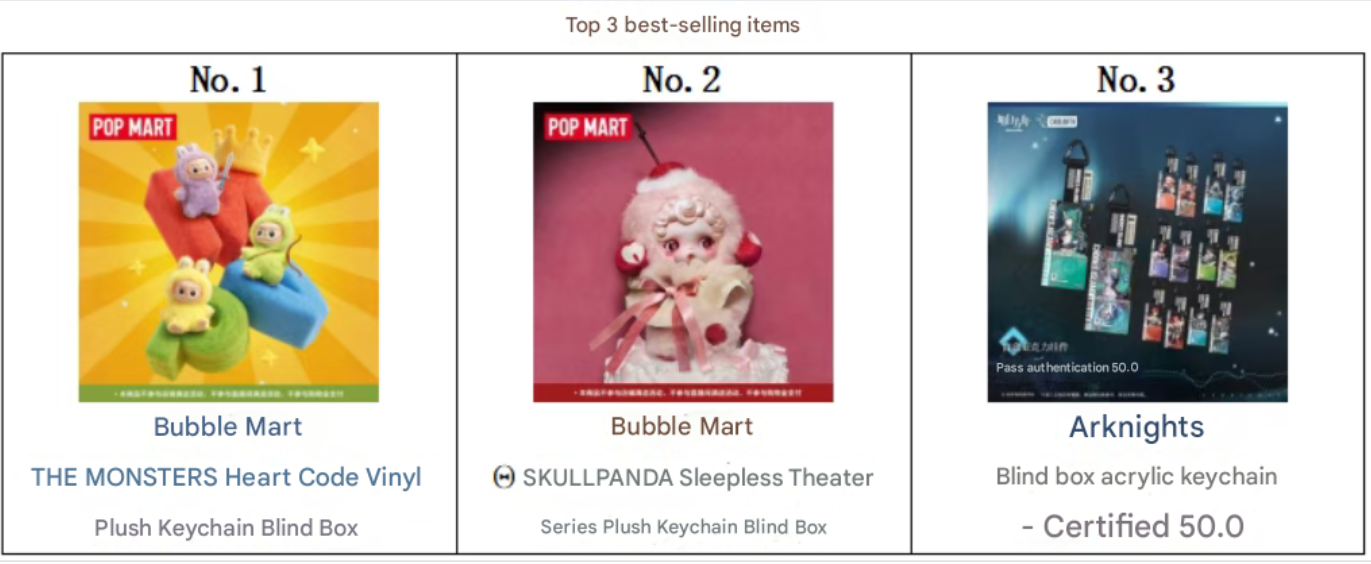

Blind Boxes (Collectibles)

Pop Mart sustained market leadership with its multi-IP ecosystem.

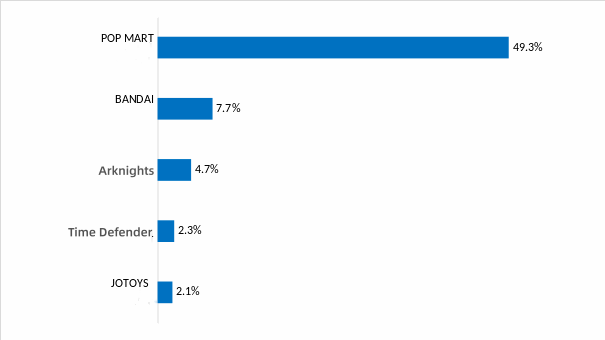

▲Top 5 Brands by Blind Boxes Sales on Tmall in October

|

▲Top 10 Best-Selling Blind Boxes Products by Sales on Tmall in October

|

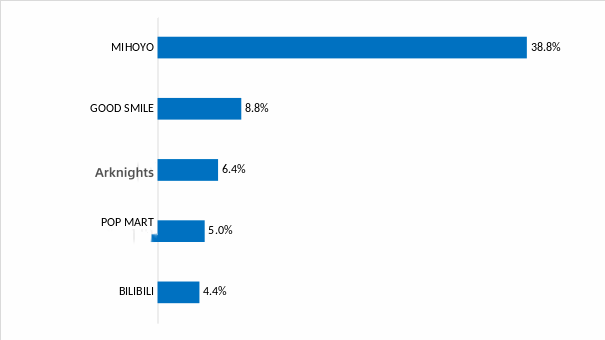

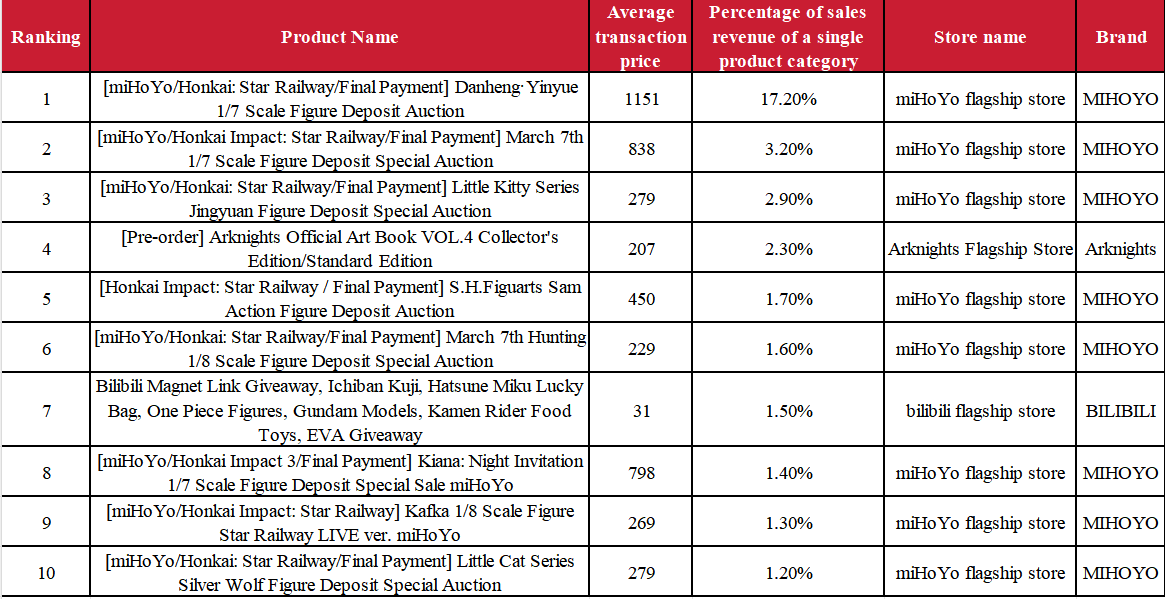

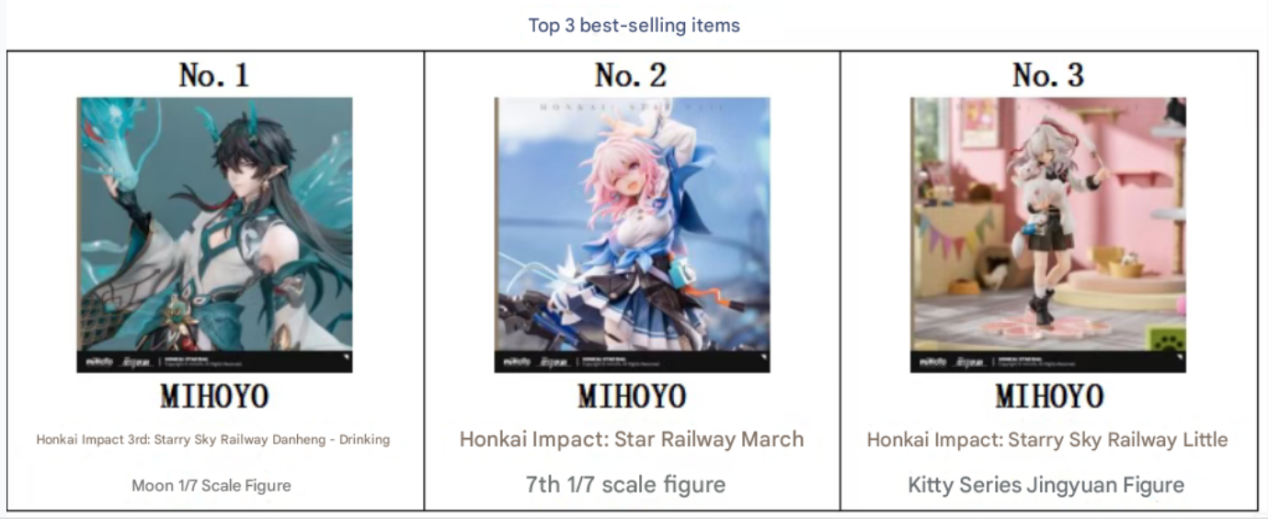

Figurines

High-end collectible figurines continue surging in popularity.

▲Top 5 Brands by Figurines Sales on Tmall in October

▲Top 10 Best-Selling Figurines Products by Sales on Tmall in October

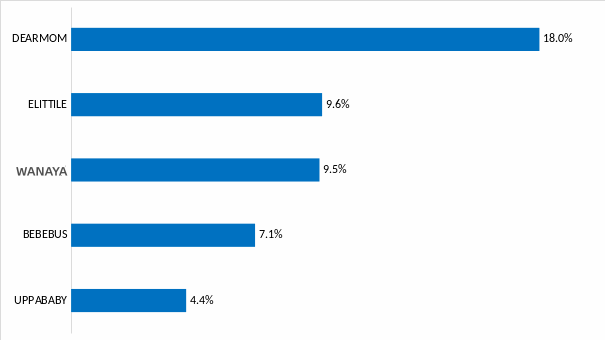

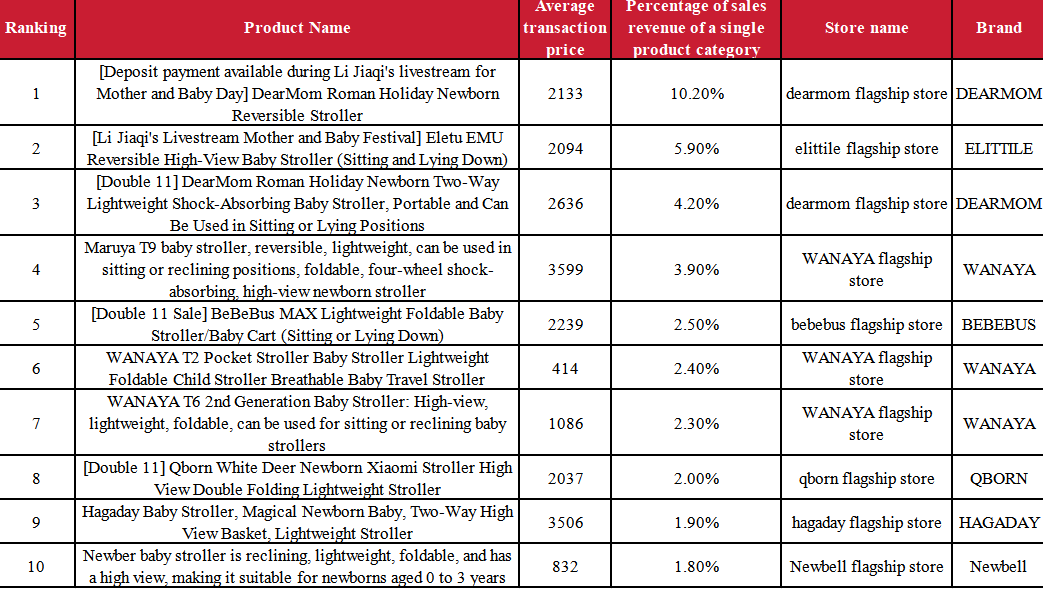

Baby Strollers

The market diverged into premium all-terrain models and ultra-portable travel models.

▲Top 5 Brands by Baby Strollers on Tmall in October

▲Top 10 Best-Selling Baby Strollers Products by Sales on Tmall in October

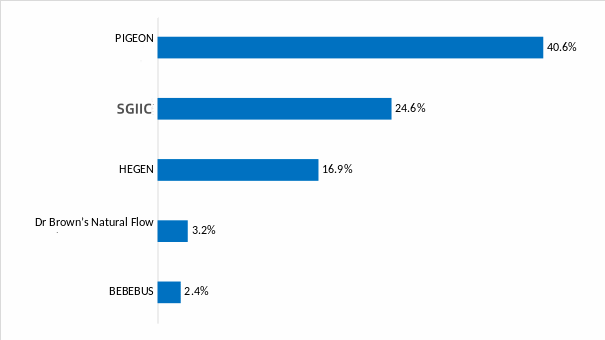

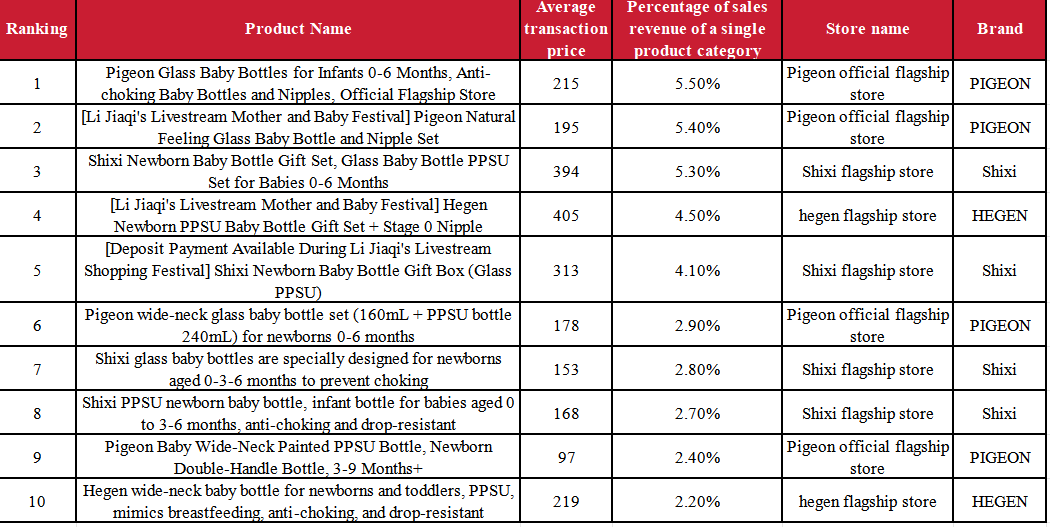

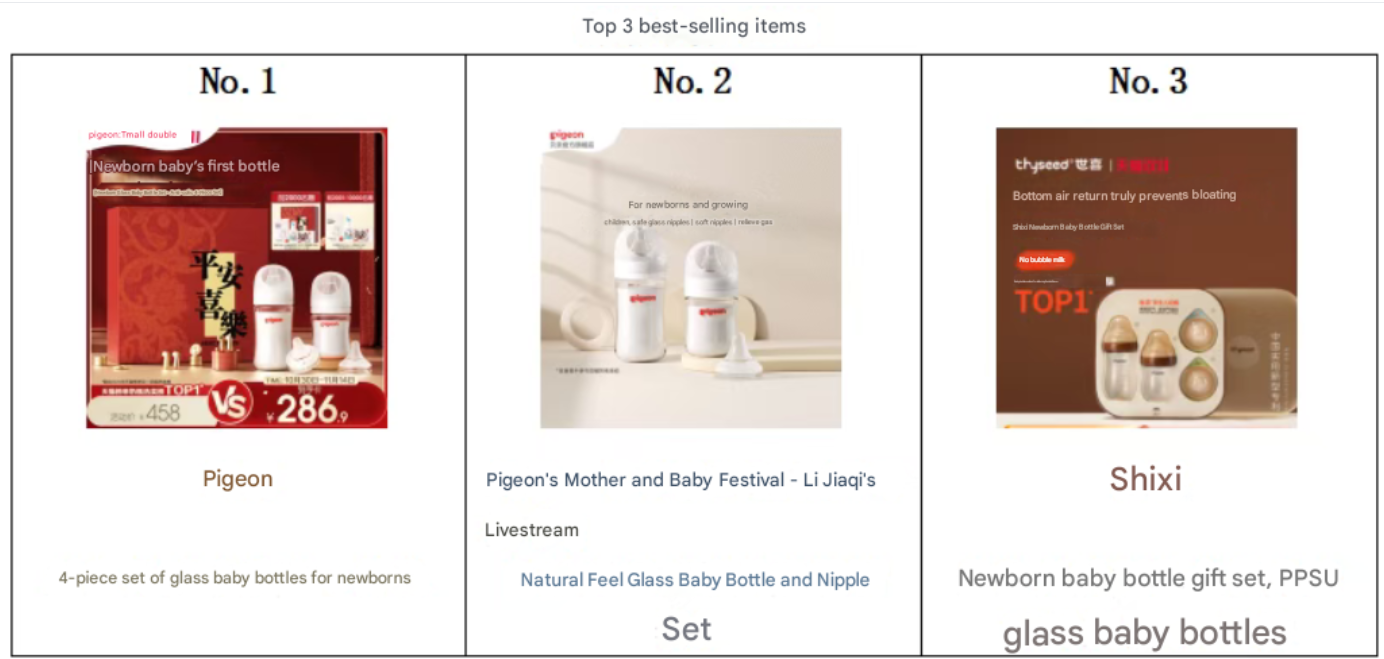

Feeding Bottles

The category remains highly concentrated.

▲Top 5 Brands by Feeding Bottles on Tmall in October

▲Top 10 Best-Selling Feeding Bottles Products by Sales on Tmall in October

Looking Ahead

A comprehensive review of China’s 2025 Double 11 performance—covering toys, trendy collectibles, and baby products—will be released soon. Global industry stakeholders are encouraged to follow CTJPA’s insights to better understand China’s evolving consumer landscape and identify new opportunities for product development, market entry, and strategic cooperation.

Trending Now! “Best Toys of Spring & Summer 2025 Influencer’s Pick List”

Recently, The Toy Association?, in collaboration with Clamour, unveiled the "2025 Spring/Summer Influencer’s Choice Toy List". The 24 selected products were meticulously evaluated by hundreds of top influencers, each with over 1 million monthly views and 500,000 followers. This highly valuable list not only highlights the urgent demand among families for diverse play experiences but also serves as a global benchmark for toy consumption trends—offering invaluable insights for product development and marketing strategies.

Earth Day: 20 Eco-Friendly and Nature-Themed Toys Reveal Emerging Industry Trends

On April 22, 2025, the 56th annual Earth Day arrives as a pivotal moment for the toy industry, which is increasingly embracing sustainability. As global environmental awareness deepens, the toy sector is accelerating efforts to build a green industry ecosystem centered on sustainable development. This shift provides families with playful options that are both engaging and environmentally responsible.?

Over 128000 professional buyers with record-breaking at CTJPA’s Four Expos in Shanghai

On October 17, the 2025 China Toy Expo (CTE), China Kids Fair (CKE), China Licensing Expo (CLE) and China Preschool Expo (CPE) concurrently held at Shanghai New International Expo Centre concluded successfully. This premier "Four-Expo-in-One" event organized by China Toy and Juvenile Products Association (CTJPA) covered 230,000 sqm floor space, with 2,629 exhibitors from 41 country and regions, especially manufacturers from 30+ production hubs. The three-day physical expos attracted 128,768 professional buyers from 185 countries and region. It shown China’s dynamic economy and extensive market potential.

Connect?with?World Class?Plush?Toy?Manufacturers?at?China?Toy?Expo?2025!

China's plush and soft toy suppliers are no longer just manufacturers — they are design-driven, trend-savvy, and globally competitive partners with robust international supply chain capabilities. These companies combine creative design, efficient production, and proven export experience to meet the fast-evolving demands of global markets.